#Panama Canal drought impact

Explore tagged Tumblr posts

Text

Labor disruption coming for supply chains

Now is the time for labor unions to press ports and railways for new benefits for workers. There is a perfect storm of labor stoppages about to take place. Thursday (that’s two days from this writing) the Teamsters Canada union (TCRC) expects to strike the CPKC railroad, one of the two largest in Canada. CPKC is also a large US and Mexico railway, and we’ve yet to see if US unions will honor a…

#Canadian National lockout#CPKC railway strike#Freight embargoes#International Longshoremen&039;s Association strike#Labor stoppages 2024#labor unions#Logistics#Panama Canal drought impact#Port of Vancouver congestion#Port strikes 2024#Railway labor disputes#Railway worker benefits#Supply Chain Disruptions#supply chains#Teamsters Canada strike#Transport logistics#US East Coast port negotiations

1 note

·

View note

Text

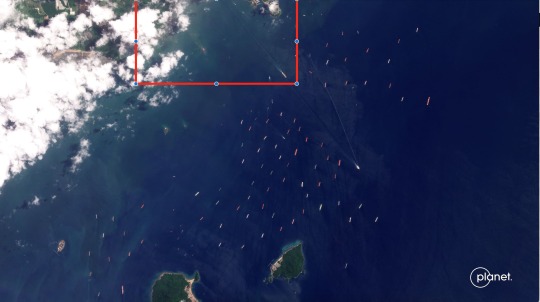

‘this is going to get worse before it gets better’: panama canal pileup due to drought reaches 154 vessels

the panama canal, a key route for global trade, is facing a crisis. 154 ships are waiting, with an average wait time of 21 days. drought has reduced the water level in the main reservoir to critically low levels, which has resulted in the canal's locks struggling to function.

40% of all u.s. container traffic travels through the panama canal every year. the current situation is a direct result of climate change and overuse of natural resources.

climate change: weather patterns have shifted, and the area is receiving much less rain than it used to. the lake that feeds the canal is refilling at a much slower rate.

overuse: development around the area has increased reliance on groundwater and freshwater sources. shipping traffic has surged, flushing more water down the canal.

each ship requires about 200 million liters to pass through, amounting to 2.8 billion liters per day at just 14 trips.

at peak season, that's 10 billion liters per day, all of it fresh water flushed into the ocean. gone. wasted. unusable.

the low water level creates two main issues: availability and pressure. emergency water conservation measures are in place, restricting the biggest boats movements and slowing down the entire process.

this ultimately leads to inflation. shit is about to become even MORE expensive.

this isn't just a problem for some boats or the shipping business. it's a reminder of how our actions and the changing climate are impacting the world in real and tangible ways. the panama canal is a microcosm of a global issue.

we have failed to recognize the interconnectedness of our world and we are paying the price. it will not improve under capitalism.

887 notes

·

View notes

Text

Conflict in The Red Sea and Drought in Panama Tie a Knot in Maritime Transport and Could Affect Brazil

Experts point to effects on agriculture and oil prices; companies create new routes and already calculate costs

Just as global economies recovered from the negative impact of Covid, adverse events on important maritime routes threaten international trade again — and could have impacts on Brazil. A historic drought has lowered the water level in the Panama Canal, reducing the flow of ships crossing the Central American country, through which about 6% of global trade passes. On the other side of the planet, attacks by Houthi rebels in the Red Sea affect the entire route passing through the Suez Canal in Egypt, with about 12% of world trade.

The most immediate impact of what has been described as the biggest crisis in maritime transport since Covid is on the increased time and cost of transportation, affecting the prices of Brazilian exports and imports, according to analysts and logistics operators heard by Folha.

Routes entering the Red Sea through the Suez Canal, for example, between Asia and Europe, are diverted to the Cape of Good Hope in southern Africa to avoid attacks on vessels. In Panama, which has restricted the number of ships that can pass daily due to the low water level, logistics operators are looking for alternatives in other means of transportation. DHL Global Forwarding, for example, offers a hybrid between maritime and air transport for routes from Brazil to the west coast of the United States.

Continue reading.

#brazil#brazilian politics#politics#economy#international politics#mod nise da silveira#image description in alt

4 notes

·

View notes

Text

Duh ! of course they will as will the backup at the Panama canal due to the drought ...added fuel added time to traverse the old routes around the horn and the good hope

4 notes

·

View notes

Text

Panama Canal Drought: How It’s Disrupting Global Shipping

The Panama Canal, a linchpin of international trade, is facing a severe drought that threatens its operations and global supply chains. As water levels in Gatún Lake hit record lows, shipping costs rise, and delays become inevitable, industries worldwide are feeling the strain. This article delves into the ongoing crisis, its implications for global trade, and the strategies needed to address this challenge.

The Panama Canal’s Vital Role in Global Trade

Spanning a strategic location, the Panama Canal facilitates the movement of nearly 5% of global seaborne trade. It saves shipping companies millions in operational costs by cutting travel time between the Atlantic and Pacific Oceans. Over 14,000 vessels passed through the canal in 2023, carrying essential goods like oil, automobiles, and electronics.

The efficient functioning of the canal depends on Gatún Lake, which supplies fresh water for its lock system. However, reduced rainfall due to El Niño and climate change has drastically lowered the lake’s levels, disrupting operations and raising global shipping costs.

Current Crisis and Its Repercussions

Drought conditions have forced the PCA to implement measures to conserve water and maintain limited operations. These include restricting vessel drafts and reducing daily transits, impacting the flow of goods worldwide.

Higher Shipping Costs: With fewer ships allowed to pass, shipping companies are forced to seek alternative routes, increasing fuel consumption and carbon emissions.

Draft Restrictions: Lower water levels necessitate restrictions on vessel drafts, reducing cargo loads and complicating logistics.

Global Trade Disruption: Delays in shipping critical goods, from medical devices to consumer products, are creating bottlenecks in supply chains.

Tackling the Drought: Strategies and Solutions

Long-term solutions are essential to mitigate the drought’s impact on the canal:

Reservoir Development: Building additional reservoirs to secure a consistent water supply for the canal’s locks.

Environmental Restoration: Initiatives to restore surrounding forests could enhance water retention and ecosystem health.

Technological Advancements: Implementing water-saving technologies and optimizing canal operations to adapt to changing climate patterns.

Conclusion

The Panama Canal drought underscores the pressing need to address climate-induced challenges in critical trade routes. Rising costs, logistical hurdles, and supply chain disruptions emphasize the urgency of collaborative efforts to find sustainable solutions. By prioritizing innovation and resilience, stakeholders can safeguard the future of global trade.

SpendEdge remains dedicated to providing insights and solutions to help industries navigate challenges like these and ensure long-term success.

Click here to talk to our experts

0 notes

Text

Archbishop Canterbury Visits Guatemala

Archbishop Justin Welby meets leaders and communities in Guatemala at the start of his 12-day Central America tour.

A Historic Visit Begins in Guatemala

In a significant visit to Central America, the Archbishop of Canterbury, the Most Reverend Justin Welby, has arrived in Guatemala. This 12-day tour marks a key moment in religious and diplomatic engagement, with meetings planned across four countries. The Archbishop's visit underscores the Church of England's commitment to supporting communities affected by climate change, migration, and violence. Welcoming the Archbishop Hosted by the British Ambassador, Nick Whittingham, and local Anglican leaders, the Archbishop's visit commenced with a meeting with the President of Guatemala, His Excellency Bernardo Arévalo. This initial encounter set the stage for discussions on various pressing issues, including environmental sustainability and social justice.

Key Highlights of the Visit

Engaging with Local Communities Archbishop Welby's visit will include numerous interactions with local Anglican churches and ecumenical communities. His agenda features worship services, community gatherings, and meetings with religious leaders. Notably, a Eucharist will be celebrated with indigenous communities in Guatemala, highlighting the rich cultural and spiritual heritage of the region. Environmental and Social Challenges The tour also emphasizes the Church's dedication to addressing environmental and social challenges. In El Salvador, the Archbishop will visit an Anglican Communion Forest, showcasing efforts to combat climate change through reforestation and conservation initiatives. Additionally, a pilgrimage to the site of St. Romero's martyrdom is planned, reflecting on the region's history of religious persecution and resilience. Addressing Migration and Violence Central America faces significant challenges related to migration and violence. The Archbishop's visit includes meetings with schools, churches, and charities working to support displaced individuals and communities impacted by these crises. Through these engagements, the Church aims to promote peace, reconciliation, and humanitarian assistance.

The Church's Role in Central America

Archbishop Welby’s tour highlights the vital role of the Anglican Church in Central America. Despite being relatively small, the Church's influence is profound, providing essential support and hope to communities in need. The Archbishop's presence reinforces the message of solidarity and compassion, advocating for those affected by climate change, violence, and migration. Itinerary of Archbishop's Tour Date Country Key Activities May 28 Guatemala Meeting with President, Eucharist with indigenous May 30 El Salvador Pilgrimage to St. Romero's site, visit Anglican Communion Forest June 3 Panama Visit drought-hit Panama Canal June 6 Costa Rica Meetings with local churches and communities

A Message of Hope and Reconciliation

Reflecting on his journey, Archbishop Welby remarked, "Central America is a region richly abundant in culture, history, and biodiversity, with millions of Christians living and worshipping across many different communities and denominations." "I am greatly looking forward to our visit, travelling through Guatemala, El Salvador, Panama, and Costa Rica, meeting and worshipping with our brothers and sisters who love and bear witness to Jesus Christ." To Summarize The Archbishop of Canterbury’s visit to Guatemala and Central America is a testament to the enduring commitment of the Church to stand with communities facing adversity. By addressing critical issues such as climate change, migration, and violence, Archbishop Welby’s tour underscores the power of faith and compassion in fostering resilience and hope. As the Archbishop continues his journey, his engagements with local leaders and communities will undoubtedly leave a lasting impact, reinforcing the shared values of peace, justice, and environmental stewardship. This historic tour not only strengthens the bonds within the Anglican Communion but also highlights the Church’s vital role in advocating for a better, more compassionate world. Sources: THX News, The Archbishop of Canterbury & British Embassy Guatemala City. Read the full article

#AnglicanCommunion#ArchbishopJustinWelby#CentralAmericachurches#Climatechangeimpact#ecumenicalcommunities#ElSalvadorpilgrimage#Guatemalatour#indigenousEucharist#PresidentBernardoArévalo#thxnews

0 notes

Text

Di Ammonium Phosphate Prices Trend, Monitor, News, Analytics and Forecast | ChemAnalyst

Di Ammonium Phosphate (DAP) Prices: During the Quarter Ending December 2023

North America:

The fourth quarter of 2023 marked an overall bullish trend in the Di Ammonium Phosphate (DAP) market in North America. Scarcity of key feedstock materials such as natural gas and phosphoric acid drove upward pressure on DAP prices. Transportation constraints in the US, including low water levels in the Mississippi River and limited railcar and truck availability, further impacted the market. Buyers' reluctance to make bulk purchases led to a decline in import prices. However, November saw a moderate surge as cost pressures on essential feedstocks like Ammonia and Phosphoric Acid were limited.

The bullish trend in the USA market was primarily attributed to elevated prices of essential feedstocks and a shortage of supplies within the region. Anticipated increases in ammonia and phosphoric acid prices may further elevate DAP prices. The quarter-ending price of DAP DEL Illinois in the USA was USD 563/MT.

Get Real Time Prices of Di Ammonium Phosphate (DAP): https://www.chemanalyst.com/Pricing-data/diammonium-phosphate-dap-1179

APAC:

In the Asia Pacific (APAC) region, the DAP market experienced a bullish trend throughout the fourth quarter of 2023. Compared to the previous quarter, the Chinese market saw a rebound with a 4.36% hike amid supply constraints and high demand. Rising prices of phosphate rock in October exerted upward pressure on DAP prices in China. Delayed production resumptions after the Golden Week holidays led to a material shortage.

November witnessed volatility due to limited product availability globally, factory equipment malfunctions, and partial sales stoppages. Import increases marginally added to cost pressures on DAP prices. The quarter-ending price of DAP FOB Qingdao in China was USD 568/MT.

Europe:

In Europe, the DAP market witnessed a continued uptrend in the fourth quarter of 2023. Scarcity of imported DAP, particularly due to a temporary halt in Ammonia production by Yara and decreased exports from European nations, contributed to supply constraints. Freight charge escalation further fueled bullish sentiments.

Moderate to low domestic demand in Germany, coupled with cautious producer approaches influenced by rising costs and logistical challenges, characterized the market. Energy-intensive facility closures, including Ammonia plants by BASF, impacted supply. Restricted production of Ammonia and its derivatives, including DAP, due to bullish trends in European gas hubs, worsened supply situations. The latest price of DAP in Germany was USD 670/MT.

MEA:

The MEA region saw a bullish to balanced DAP market in the fourth quarter of 2023. Strong demand from international fertilizer markets, limited spot DAP availability, and resumed production activities in leading ammonia and phosphate plants in Saudi Arabia contributed to a moderate to low supply situation. Increased prices of essential feedstocks further elevated DAP prices. However, declining ammonia prices and ample global DAP availability stabilized prices in December. The FOB price of DAP at Jeddah port in Saudi Arabia was USD 590/MT for the quarter.

South America:

In South America, the DAP market witnessed a bullish trend throughout the fourth quarter of 2023. Scarcity of imported supplies due to drought conditions in the Panama Canal and subdued demand from end-user fertilizer markets drove prices up. Brazil experienced significant price increases due to a focus on soybean and corn cultivation, leading to higher fertilizer demand. Costly imports and the suspension of DAP exports from China contributed to rising prices, further exacerbated by currency depreciation against the US Dollar.

Get Real Time Prices of Di Ammonium Phosphate (DAP): https://www.chemanalyst.com/Pricing-data/diammonium-phosphate-dap-1179

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Ammonia Prices, Demand & Supply | ChemAnalyst

In Q4 2023, the North American region experienced a bullish trend in the Ammonia prices, driven by several key factors. Firstly, a rise in the price of essential feedstock natural gas elevated the production costs of Ammonia. Secondly, there was strong demand for Ammonia and its derivatives in the domestic market, particularly in anticipation of the upcoming winter planting season, resulting in upward pressure on prices. Additionally, limited material availability within the regional market contributed to increased Ammonia prices domestically.

Moreover, as the Chinese government restricted fertilizer exports, international consumers, especially Indian players, actively engaged in the North American market. However, in December 2023, prices declined significantly due to a surplus of available material within the North American market.

Prolonged drought conditions and persistent bottlenecks at the Panama Canal, a crucial trading route in the USA, resulted in delayed exports and long queues, leading to a buildup of inventories at the port. Furthermore, demand from the South American region remained subdued during this period due to adverse drought conditions caused by the El-Nino effect. The combined effect of these factors narrowed the gap between demand and supply, thus supporting the current price decrease.

Track Real Time Ammonia Prices: https://www.chemanalyst.com/Pricing-data/ammonia-37

During Q4 2023, the pricing dynamics of Ammonia in South America were influenced by various factors. Initially, the market exhibited bullish sentiments in the first two months of the quarter. However, as December approached, the Ammonia market in the Middle Eastern region took a downturn. In the beginning of the quarter, the Ammonia market in Brazil started on a notably bullish note, primarily driven by costly imports from the USA market and a shortage of imported Ammonia within the domestic market.

Major exporting nations, particularly the USA, experienced this surge, prompting producers to exercise caution in expanding Ammonia production. Additionally, a shortage of gas pipelines further constrained the availability of crucial raw materials. Concurrently, persistent bottlenecks at the Panama Canal added another layer of complexity, resulting in prolonged queues for ships. These disruptions not only affected shipping schedules but also led to a subsequent increase in transportation costs, directly impacting the smooth flow of Ammonia shipments into the Brazil market.

However, despite the onset of the planting season for crops like Rice, Soyabean, and Sorghum, demand for Ammonia and other fertilizers remained subdued in the Brazil market due to prolonged drought conditions caused by the El-Nino effect. Extremely hot weather conditions in the northern part of Brazil, coupled with dry conditions during the first half of December 2023, exacerbated the crop situation within the country. Meanwhile, temperatures were cooler in the southern part of the country during the first half of the month, though they rose later in the month.

The disparity in wet weather in southern Brazil and drier weather farther north is primarily driven by El Niño, which is expected to persist into the first part of 2024. This has dampened the purchasing enthusiasm of fertilizer consumers amid potential threats to crops.

About Us:

Welcome to ChemAnalyst, the future of chemical and petrochemical market intelligence, where innovation meets insight. Awarded the prestigious titles of ‘The Product Innovator of the Year, 2023’ and recognized among the "Top 100 Digital Procurement Solutions Companies," we stand at the forefront of the digital transformation in the chemical industry. Our cutting-edge online platform revolutionizes the way companies approach the volatile chemical market, offering an unparalleled depth of market analysis, real-time pricing, and the latest industry news and deals from around the globe. Dive into the future with us, where tracking over 500 chemical prices across more than 40 countries is not just possible—it's effortless.

With ChemAnalyst, you gain a strategic advantage. Our expansive database covers over 500 chemical commodities, providing detailed insights into Production, Demand, Supply, Plant Operating Rates, Imports, Exports, and beyond. Our forecasts stretch up to a decade, offering not just historical data analysis but a glimpse into the future of the chemical markets. Supported by local field teams in over 40 countries, we ensure the data you receive is not only comprehensive but also meticulously verified, offering you reliability unmatched in the industry.

Contact Us:

420 Lexington Avenue, Suite 300

New York, NY

United States, 10170

Email-id: [email protected]

Mobile no: +1 - 3322586602

#ammonia#ammoniaprices#ammoniamarket#ammonianews#ammoniademand#ammoniasupply#ammoniapricetrend#ammoniapriceforecast#ammoniamarketprice#priceofammonia

1 note

·

View note

Text

0 notes

Text

The Logistics Impact of disruptions in the Suez and Panama canals

An article in the Wall Street Journal, March 10 2024, titled “Two Canals, Two Big Problems – One Global Shipping Mess” describes the logistics impact of low water levels in the Panama Canal and the Houthi rebel attacks on ships going through the Suez Canal. Drought in Panama has described daily ship traffic through the Panama Canal from 36 ships down to a projected 18 in February, with prices…

View On WordPress

0 notes

Photo

Supply Chain Brief: National Vista Outdoor announced a 1-7% ammunition price increase (10% increase in one case) that coincided with a donation of 1 million rounds of ammo to Ukraine. Brands affected are Remington, Alliant Powder, CCI, Federal, HEVI-Shot, and Speer. NATO also committed $2.58 billion in contracts for ammunition to Ukraine. Debrief: Vista Outdoors, just sold to the Czechoslovak Group (CSG), a Czech Republic ammo manufacturer. The ammo impacted falls under the effect of that sale including CCI, Speer, Remington, HEVI-Shot, and Federal rounds. The CEO of Ammo Inc predicts a sharp rise in ammo costs in 2024 saying, “5.56 NATO and .223 Rem., 7.62x39 mm, all your larger rifle calibers, anything related to military calibers, because of the news between Israel and Hamas.” U.S. consumers will se...(CLASSIFIED) Food industry analysts cite an El Niño phenomenon, export restrictions, increased energy costs, increased interest rates, and increased biofuel commitments as causes for a predicted “food supply crisis”. Wheat, corn, soybeans, palm oil, and rice disruptions reported due to El Niño caused droughts. Biofuel growth is expected to impact availability of oils used in the food industry. Drought in affected regions has led to those areas increasing imports of grains which subsequently decrease availability of exports to other non-impacted regions. The Economic Research Service (ERS) predicts a 2.9% increase in food prices overall, 1.9% increase for at-home food prices, and 4.3% increase for pre-prepared foods (restaurants). Additionally, the ERS predicts a 7.8% increase in beef and 5.6% in meats overall. Food industry analysts further warn that both “affordability but also availability” of food goods will be impacted and that there is a...(CLASSIFIED) The Panama Canal Authority announced an additional set of restrictions to reduce transit capacity as a result of continued low-water levels at Gatun Lake. In August, the number of ships permitted to pass through the canal was reduced from 36 to 32. Authorities have now reduced that number to 25. The canal, prior to the water level induced reduction, saw 6%+ of global trade goods pass. Debrief: Reduct

0 notes

Text

Friday, January 19, 2024

Snow, chilly winds in Vancouver shut schools, hinder air traffic (Reuters) Schools remained shut and flights were impacted in Vancouver on Wednesday as weather forecasters warned of heavy snowfall and frigid winds sweeping across the Pacific Coast Canadian city. Western Canada is emerging from a blast of arctic temperatures over the weekend, and while temperatures have risen from the minus 9 degrees Celsius (16 degrees Fahrenheit) recorded on Sunday, federal meteorologists forecast 10 to 15 centimeters (4-6 inches) of snow and a wind chill of minus 7 degrees Celsius on Wednesday.

Why the World Is Betting Against American Democracy (Politico magazine) When I asked the European ambassador to talk to me about America’s deepening partisan divide, I expected a polite brushoff at best. Foreign diplomats are usually loath to discuss domestic U.S. politics. Instead, the ambassador unloaded for an hour, warning that America’s poisonous politics are hurting its security, its economy, its friends and its standing as a pillar of democracy and global stability. The U.S. is a “fat buffalo trying to take a nap” as hungry wolves approach, the envoy mused. “I can hear those Champagne bottle corks popping in Moscow—like it’s Christmas every ... day.” Some of the diplomats stressed they admire America—some attended college here. They acknowledged they don’t have some magical solution to the forces deepening its political polarization. But they’re worried today’s U.S. political divisions could have lasting impact on an increasingly interconnected world. A former Asian ambassador said, “We’ve gone from a unipolar world that we’re familiar with from the 1990s into a multipolar world, but the key pole is still the United States. And if that key pole is not playing the role that we want the U.S. to do, you’ll see alternative forces coming up.”

Traffic through the Panama Canal is being slashed because of drought, disrupting global trade (AP) A severe drought that began last year has forced authorities to slash ship crossings by 36% in the Panama Canal, one of the world’s most important trade routes. The new cuts announced Wednesday by authorities in Panama are set to deal an even greater economic blow than previously expected. Canal administrators now estimate that dipping water levels could cost them between $500 million and $700 million in 2024, compared to previous estimates of $200 million. One of the most severe droughts to ever hit the Central American nation has stirred chaos in the 50-mile maritime route, causing a traffic jam of boats, casting doubts on the canal’s reliability for international shipping and raising concerns about its affect on global trade.

Royal surgeries (Washington Post) The British royal palaces made unusual back-to-back health announcements. Catherine, Princess of Wales and wife to the future British king, underwent “successful” abdominal surgery and would remain hospitalized for up to two weeks, Kensington Palace said, and probably would not resume her official duties before April. The palace did not offer additional details about what procedure was performed. Soon after, Buckingham Palace announced that Charles, 75, would undergo a “corrective procedure” next week for an enlarged prostate.

Pakistan launches retaliatory airstrikes in Iran after an earlier attack by Tehran (AP) Pakistan’s air force launched retaliatory airstrikes early Thursday in Iran allegedly targeting militant hideouts, an attack that killed at least nine people and further raised tensions between the neighboring nations. The tit-for-tat attacks Tuesday and Thursday appeared to target two Baluch militant groups with similar separatist goals on both sides of the Iran-Pakistan border. However, the two countries have accused each other of providing safe haven to the groups in their respective territories. The strikes imperil diplomatic relations between the two neighbors, as Iran and nuclear-armed Pakistan have long regarded each other with suspicion over militant attacks. Each nation also faces its own internal political pressures—and the strikes may in part be in response to that.

For many in China, the economy feels like it is in recession (Reuters) The night before China’s civil service exam, Melody Zhang anxiously paced up and down the corridor of her dormitory, rehearsing her answers. Zhang was hoping to start a career in state propaganda after more than 100 unsuccessful job applications in the media industry. With a record 2.6 million people going for 39,600 government jobs amid a youth unemployment crisis, she didn’t get through. “The endless job-hunting is a torture,” said the 24-year-old graduate from China’s top Renmin University. A crisis of confidence in the economy is deterring consumers from spending and businesses from hiring and investing, in what could become a self-feeding mechanism that erodes China’s long-term economic potential. China grew 5.2% last year, more than most major economies. But for the unemployed graduates, the property owners who feel poorer as their flats are losing value, and the workers earning less than the year before, the world’s second-largest economy feels like it’s shrinking.

UN: Palestinians are dying in hospitals as estimated 60,000 wounded overwhelm remaining doctors (AP) Palestinians are dying every day in Gaza’s overwhelmed remaining hospitals which can’t deal with the tens of thousands people hurt in Israeli’s military offensive, a U.N. health emergency expert said Wednesday, while a doctor with the International Rescue Committee called the situation in Gaza’s hospitals the most extreme she had ever seen. The two health professionals, who recently left Gaza after weeks working in hospitals there, described overwhelmed doctors trying to save the lives of thousands of wounded people amid collapsing hospitals that have turned into impromptu refugee camps. The World Health Organization’s Sean Casey, who left Gaza recently after five weeks of trying to get more staff and supplies to the territory’s 16 partially functioning hospitals, told a U.N. news conference that he saw “a really horrifying situation in the hospitals” as the health system collapsed day by day. The Health Ministry in Gaza estimates that 60,000 people have been wounded, with hundreds more wounded per day.

As famine looms in Gaza, aid delivery remains difficult and dangerous (Washington Post) Describing the humanitarian situation in the Gaza Strip in increasingly apocalyptic terms, aid agencies are urging Israel to ease the difficult and often dangerous process of delivering supplies to desperate Palestinians. Famine is looming in Gaza, the United Nations warns. The World Food Program estimates that 93 percent of the population faces crisis levels of hunger. Disease is spreading rapidly. The World Health Organization predicts that the death toll from sickness and starvation in coming months could eclipse the number of people killed in the war so far—more than 24,000, according to the latest count from the Gaza Health Ministry, with the majority women and children. Aid agencies say the chief factors hampering the delivery of lifesaving assistance to Gazans fall almost entirely under Israel’s control—the Israeli inspection process for aid remains lengthy and inefficient; there aren’t enough trucks or fuel inside Gaza to distribute the aid; mechanisms to protect humanitarian workers are unreliable; and commercial goods have only just begun to trickle in. Large swaths of Gaza remain off-limits to aid workers. Frequent telecommunications blackouts complicate their work. And the war still rages.

3 killed and 77 injured in a massive blast caused by explosives in a southern Nigerian city (AP) Three people died and 77 others were injured overnight when an explosives rocked more than 20 buildings in one of Nigeria’s largest cities, authorities said Wednesday, as rescue workers dug through the rubble in search of those feared trapped. Residents in the southwestern state of Oyo’s densely populated Ibadan city heard a loud blast at about 7:45 p.m. Tuesday, causing panic as many fled their homes. Preliminary investigations showed the blast was caused by explosives stored for use in illegal mining operations, Oyo Gov. Seyi Makinde told reporters after visiting the site in the Bodija area of Ibadan.

Tobacco use falling worldwide but Big Tobacco fighting to reverse trend, WHO says (CBS News) The number of adult tobacco users has dropped steadily in recent years, the World Health Organization said on Tuesday, but it warned Big Tobacco is working hard to reverse that trend. In 2022, about one-in-five adults around the world were smokers or consumed other tobacco products, compared to one-in-every-three in 2000, the United Nations health agency said. Currently, tobacco use is still estimated to kill more than eight million people each year, including an estimated 1.3 million non-smokers who are exposed to second-hand smoke, WHO statistics show. While celebrating the advances that have been made, the WHO warned that the tobacco industry was intent on rolling them back.

Satellites and our view of the skies (Nikkei Asia) There are approximately 9,000 satellites orbiting the world, 60 percent of which are communications satellites that have been launched since 2020. These comms satellites—5,600 of which are from SpaceX alone—fly rather low, and are reportedly causing issues with seeing space from Earth. This is an issue, as SpaceX plans to launch 42,000 satellites, a Chinese rival plans to launch 13,000, and kit and caboodle the major comms satellite players intend to toss 65,000 satellites into orbit.

0 notes

Text

Panama Canal Crisis: Severe Drought Forces Drastic Cuts in Vessel Traffic

The crisis extends its reach across various sectors, affecting the transport of crucial items like coal and LNG. The delay in shipping agricultural products from and to the U.S. amplifies the global impact.

0 notes

Text

Love is a complex emotion that is essential to human well-being. It is a feeling of deep affection and care for another person, and it can be expressed in many different ways, including through physical touch, words of affirmation, acts of service, gifts, and quality time.

There are many reasons why people cannot live without love. First, love is a source of great happiness and joy. When we feel loved, we feel supported, accepted, and valued. This can have a positive impact on our mental and physical health.

Second, love helps us to cope with difficult times. When we are going through a tough time, it is helpful to know that there are people who care about us and want to help us through it. Love can give us the strength and resilience to overcome challenges.

Third, love helps us to grow and learn. When we are in a loving relationship, we are constantly learning about ourselves and about the other person. This can help us to become better people.

Finally, love is a fundamental human need. We all have a need to feel connected to others and to feel loved. When this need is met, we can thrive.

0 notes

Text

"Water Woes: Unveiling the Crisis Plaguing Major Shipping Routes"

The impact of climate-driven extreme weather events on major shipping routes around the world is increasing, and the onset of El Niño could worsen the situation. In drought-stricken Panama, low water levels have led to restrictions on vessels passing through the Panama Canal, causing a backlog of ships waiting to traverse the route. The Panama Canal Authority stated that these measures were…

View On WordPress

0 notes

Text

Vinyl Ester Resin Prices Trend, Monitor, News & Forecast | ChemAnalyst

Vinyl Ester Resin (VER) Prices: During the Quarter Ending December 2023

North America:

In the fourth quarter of 2023, the North American Vinyl Ester Resin (VER) market witnessed a bearish price trend, largely influenced by challenges in the construction industry, resulting in diminished buying interest from end-users.

Despite manufacturers producing VER in anticipation of future demand, the market saw a surplus in supply throughout the quarter, dampening pricing dynamics. Specifically in the USA, VER prices experienced a significant downturn. However, consistent supply was maintained with no reported plant shutdowns.

The pricing trend in the USA was shaped by various factors, leading to a bearish market sentiment overall. Low demand and ample supply were the primary drivers of the downward pricing trend for Vinyl Ester Resin in North America during the fourth quarter of 2023.

Get Real Time Prices of Vinyl Ester Resin (VER): https://www.chemanalyst.com/Pricing-data/vinyl-ester-resin-1293

APAC:

In Q4 2023, the APAC Vinyl Ester Resin (VER) market exhibited mixed pricing trends, initially declining but rebounding by the quarter's end. Moderate demand prevailed in most countries, with China experiencing a bullish trend due to robust demand, leading to price increases.

Insufficient product availability coupled with increased demand prompted sellers to raise prices, further influenced by fluctuations in feedstock Epoxy Resin costs. The market dynamics were driven by increased demand, sufficient inventories amid bearish demand, and anticipated growth in downstream industries, particularly in China, resulting in higher prices. Vinyl Ester Resin-Novalac Based CFR Qingdao in China reached USD 3040/MT by December 2023.

Europe:

The European Vinyl Ester Resin market in Q4 2023 saw a mixed trajectory, with initial and mid-quarter price highs followed by a decline by the quarter's end. Volatility in feedstock Epoxy Resin prices increased manufacturing costs, contributing to the price surge.

Disruptions in the supply chain, linked to elevated spot prices of refined products on the US West Coast, further impacted prices. Production losses due to supply constraints and refinery shutdowns were exacerbated by navigational challenges at the Panama Canal, where a rare drought situation hindered vessel passage. To address this, the Panama Canal Authority implemented premiums on heavy and large ships, reducing transported goods volume. These complex challenges underscored the intricate dynamics faced by the European Vinyl Ester Resin market during this period.

Get Real Time Prices of Vinyl Ester Resin (VER): https://www.chemanalyst.com/Pricing-data/vinyl-ester-resin-1293

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes